Triumph the Insult Comic Dog interviews Ralph Nader

"There are three things I have learned never to discuss with people: religion, politics, and the Great Pumpkin." -- Linus van Pelt in It's the Great Pumpkin, Charlie Brown

One of the reasons I stopped blogging-- and why I don't even read as many blogs as I used to-- is that it just becomes a masturbatory echo chamber after a while. Conservative blogs (I am so addicted to the National Review's 'The Corner' site) are hysterical in this regard, as they ignore most substantive issues-- *coughDrudgecough*-- in lieu of chest-pounding anger and rants about socialism and jokes about Al Gore and celebrities (who says they're stuck in the past!). But many liberal blogs are guilty of this as well, having convinced themselves that there's no way, in this year especially, that John McCain could win. And then the GOP snuck in, with their usual distract-and-divide tactics, and are giving Obama and the Democrats a real run for their money. Ask President Kerry what underestimating ones opponent gets you.

Not that it's getting much press so far, but Obama came out swinging on the economy today-

Time magazine's Joe Klein wrote a great blog post yesterday (darn that liberal media!!) on the insanity of the idea that John McCain and the Republican party are the ones who can/should be elected to fix this economic mess. I reprint it in full, because I wish this was an Obama stump speech this week-

John McCain is up with an ad touting his "experience" to deal with the financial crisis. But no specific experience is cited--which is attributable to the fact that McCain has been a happily orthodox Republican when it comes to financial regulation these past 26 years. He's against it. He's against Washington telling you how to run your business. The unseen hand of the market and all that...

This has been the long-standing Republican bait and switch--scaring small businesses with the threat of new regulations if the Democrats win, commiserating with larger businesses about the evils of environmental and plant safety rules, while lifting as many regulations as possible governing the financial titans whose credit should be at the heart of new economic development. But that hasn't been happening: the financial titans have been going for the quick buck rather than the sound one. Money and creativity have been redirected during the Reagan-Bush era away from substantive loans to real businesses into a Ponzi scheme of borrowing by investment bankers, so they could engage in the most irresponsible, if lucrative (for them) speculative lending imaginable...In this sense, the mortgage crisis was a perfect metaphor for Republican financial governance: Investment banks like Lehman--R.I.P.--took loans to invest money in...bad loans. In this case, the loans were bad mortgages. This is called throwing good money after bad.

Actually, John McCain has excellent experience--a ringside seat--in the vagaries of this experiment in greed and anarchy. He was a member of the Keating Five. This was the signature scandal of the Savings and Loan crisis, twenty years ago. It concerned the insider help that five Senators gave Charles Keating and his Lincoln Savings and Loan, in return for contributions and gifts. The deregulation of S&Ls--community banks dedicated to local mortgages (like George Bailey's bank in "It's A Wonderful Life")--enabled slick operators like Keating to make reckless loans in new areas where they had no expertise. The final tab to the taxpayers was $165 billion.

McCain wasn't the worst offender in the scandal. He was included in the Five to make it bipartisan (the other four were Democrats). But he knew Keating, partied with him, made inquiries on his behalf. He once told me that his role in the scandal was harder on him, in some ways, than being a prisoner of war "Because my honor was called into question."

After an experience like that, you might think Senator Honorable would have devoted himself to preventing other such crises--to making sure the Big Wall Street Casino was operating according to rules that wouldn't screw the small investors and, more to the point, the taxpayers. But he walked the anti-regulatory party line, with only occasional exceptions...and tried to lay down a smokescreen of righteousness by campaigning against small potato[e!]s like legislative earmarks--money to study the mating habits of, uh, crabs, in, uh, Alaska (proposed by Governor Honorable).

What we are seeing on Wall Street today is the result of an ideology gone amok. There was call to loosen and change the antiquated regulations governing investment back in 1980. But the Republican era has seen that loosening go to the point of near-cataclysm. Banks are failing, markets dropping. We are in the midst of a slow-motion economic crash. What happens next is an economic contraction: loans aren't available, so businesses can't expand. A crash comes at the beginning of a period of economic trouble.

John McCain, after his political near-death experience, could have made the responsible regulation of markets one of his great causes. He didn't. And today he said, once again, "The fundamentals of our economy are strong." I hope he's right, but it's entirely possible that he knows as much about our economy as Sarah Palin knows about The Bush Doctrine.

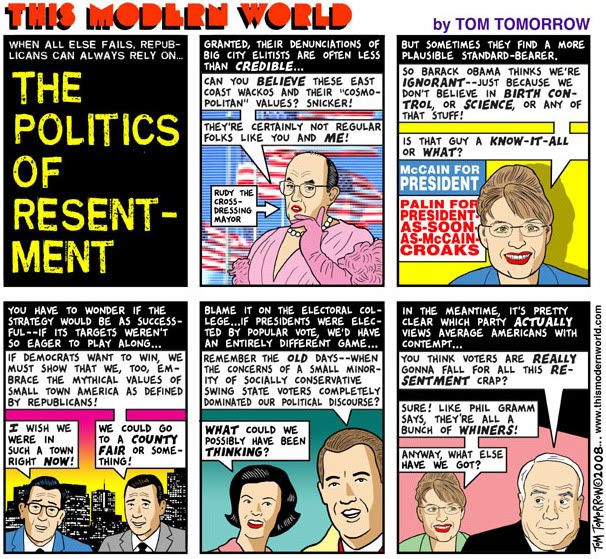

This new Tom Tomorrow cartoon pretty much sums up the GOP's strategy that they've been running with since their convention. I'd find it pretty hysterical if the polls weren't indicating that the usual distract-and-divide tactic was working gangbusters for them again.

This is an entry I originally posted in March... it deserves repeating today for obvious reasons. Courtesy of the PBS News Hours the weekend after Bear Sterns went down, a succinct 11-minute report explaining how problems in the housing market spread into the wider economy.

This story about the fall of Lehman Brothers (and AIG and Washington Mutual and Merrill Lynch?) is just part of a larger economic story that began officially with the downfall of Bear Sterns earlier this year, but really traces back to years and years of bad, shortsighted economic policy ("ownership society"!). It is, by far, the most depressingly ignored issue of the campaign right now. They're just not discussing it all.

Paul Begala speaks to Bill Maher with some advice for Obama. Even Karl Rove knows that John McCain is a huge liar. About everything. And, finally, Tina Fey just nails Sarah Palin ("And I can see Russia from my house!").