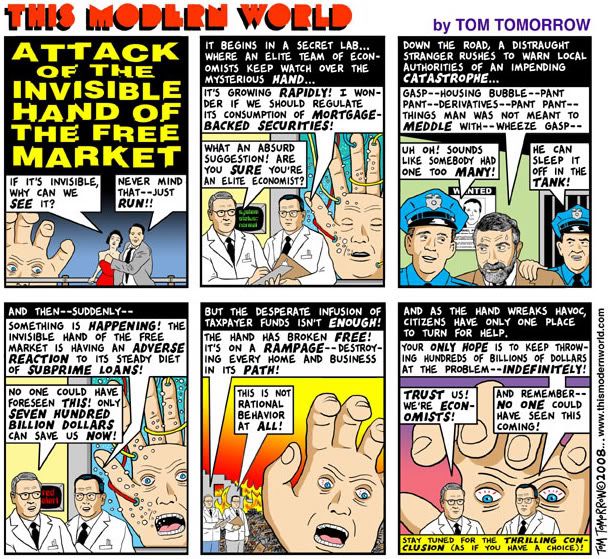

The Invisible Hand of the Free Market

As the Republican party (once again) decides that organized labor/working people are the enemies to be destroyed in this economic crisis (using both the auto bailout and the... Blagojevich scandal?), reality continues to pack a one-two punch. Here's some of this week's most exciting free-market news.

There was this news this morning...

A record plunge in consumer prices in November puts pressure on the Federal Reserve to act decisively to guard against a debilitating bout of deflation.

The Fed wraps up a two-day meeting Tuesday. Economists expect the central bank to cut the federal funds rate.

...And then this followup this afternoon-

The Federal Reserve has cut its target for a key interest rate to the lowest level on record and pledged to use "all available tools" to combat a severe financial crisis and prolonged recession.

The central bank on Tuesday said it had reduced the federal funds rate, the interest that banks charge each other, to a range of zero to 0.25 percent. That is down from the 1 percent target rate in effect since the last meeting in October.

Now I'm no economic expert, but this seems... rash? Which means the market loved it.

I also came across this criminally underreported story yesterday-

Congress wanted to guarantee that the $700 billion financial bailout would limit the eye-popping pay of Wall Street executives, so lawmakers included a mechanism for reviewing executive compensation and penalizing firms that break the rules.

But at the last minute, the Bush administration insisted on a one-sentence change to the provision, congressional aides said. The change stipulated that the penalty would apply only to firms that received bailout funds by selling troubled assets to the government in an auction, which was the way the Treasury Department had said it planned to use the money.

Now, however, the small change looks more like a giant loophole, according to lawmakers and legal experts. In a reversal, the Bush administration has not used auctions for any of the $335 billion committed so far from the rescue package, nor does it plan to use them in the future. Lawmakers and legal experts say the change has effectively repealed the only enforcement mechanism in the law dealing with lavish pay for top executives...

Now I'm sure that a) President Bush doesn't want to come off as cartoonishly evil and that, b) the GOP doesn't want to be seen as the party of the rich and big business, so I'm advising them to be a little less obvious next time. You're welcome.

And, finally, one of the week's biggest stories is a heartwarming story of unchecked greed-

Commentators sharply criticized the US financial system Tuesday as more firms announced losses in the suspected multi-billion-dollar swindle run by ex-Wall Street heavyweight Bernard Madoff...

..."The supposed meticulous supervision by (US financial watchdog) the SEC has failed in the task of preventing massive fraud," Spanish newspaper El Pais said Tuesday.

...Madoff, 70, was arrested Thursday and allegedly confessed to defrauding investors of 50 billion dollars in a scam that collapsed after clients asked for their money back due to the global financial crisis.

US authorities allege that Madoff delivered consistently strong returns to clients by secretly using the principal investment from new investors for payments to other investors, in what is known as a pyramid scam.

...US Vice President Dick Cheney said in a radio interview Monday that the alleged scam was "very disturbing" and blamed a few "bad apples."

'A few bad apples'? Seriously, Dick Cheney? I'd pick a different phrase, if I were you.

In conclusion... we need to kick some union ass. The bastards.

0 Comments:

Post a Comment

<< Home